Digital Industrial Venture Capital

ABOUT

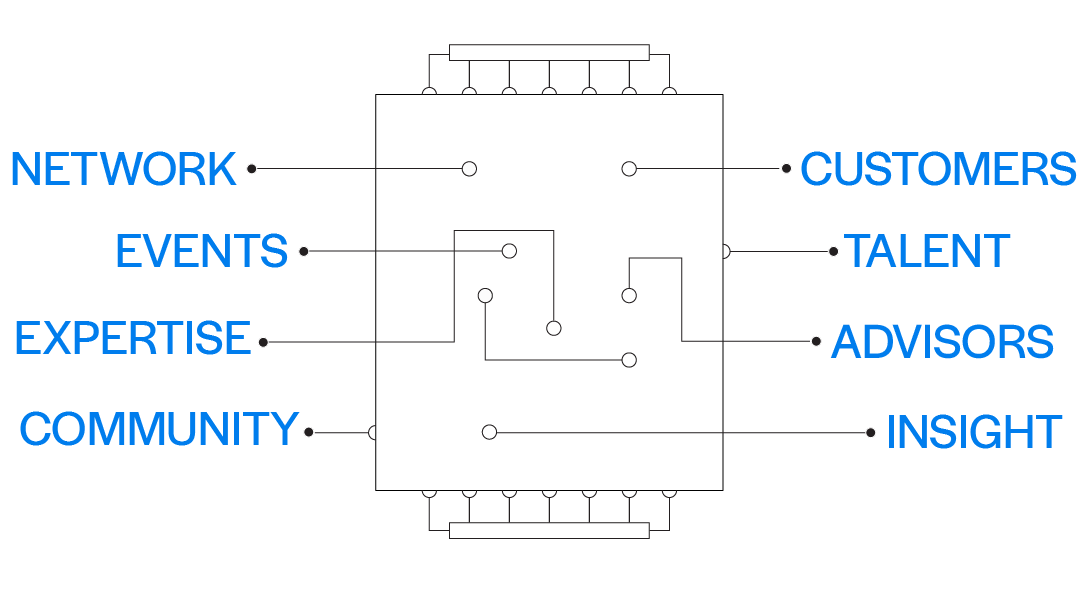

Schematic Ventures is an early-stage venture capital fund located in San Francisco. The fund is focused on investments in technology companies within supply chain, manufacturing, commerce infrastructure & digital industrial sectors.

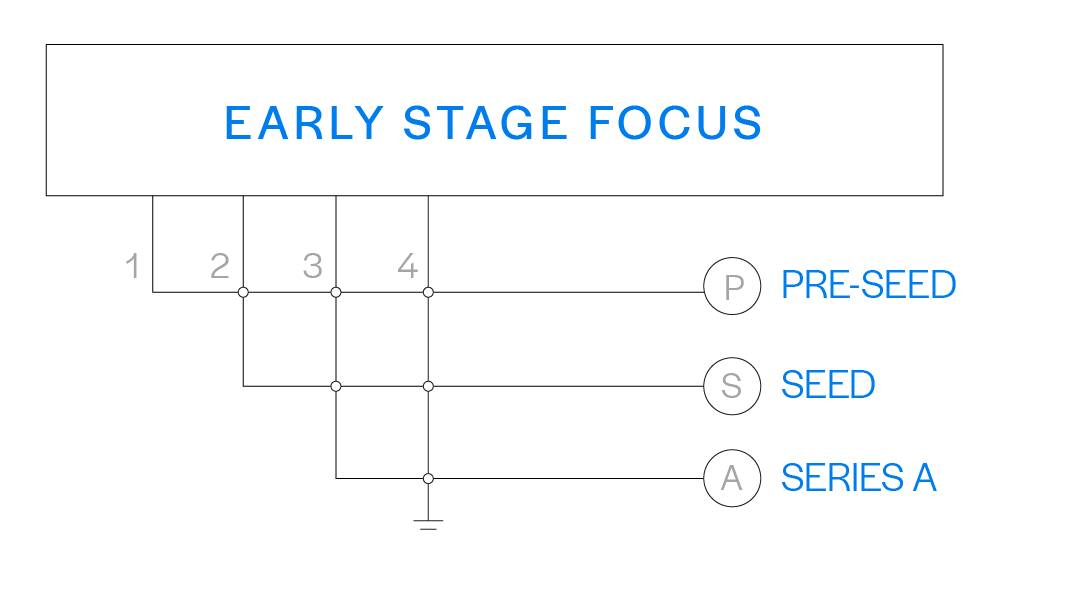

Pre-Seed to Series A Stage

Lead and Co-Invest

Proven Results

PORTFOLIO

TEAM

Julian Counihan - General Partner

Julian Counihan -

General Partner

Julian started a career in technology as a software developer at Fortna where he worked on warehouse control & automation systems. After a period in technology investment banking, he began investing in industrial hardware and supply chain sectors at a venture capital fund in New York.

Julian graduated magna cum laude from UVA with a BsC in systems engineering, holds an MBA from MIT and is a first generation American.

Alex Freed - Partner

Alex Freed -

Partner

Alex has been working in technology his entire career. At Google, he initially focused on launching new products in the ecommerce segment. Later, he joined a team that led the international expansion and growth strategy of media & advertising products.

Alex holds an MBA from Columbia Business School and a BA in Economics from NYU. Raised in California, he’s a native Russian speaker and has lived around the world.

Aditya Raghupathy - Associate

Aditya Raghupathy -

Associate

Aditya brings experience in operations and a passion for manufacturing to Schematic. At Deloitte, he focused on smart factory applications across consumer and industrial products manufacturers. Later, as part of Deloitte's technology innovation group, Deloitte Catalyst, he led the scouting and evaluation of industrial startups.

Aditya holds an BS in Industrial Engineering from Georgia Tech. Raised in Atlanta, Aditya is a first generation American and a second generation supply chain leader.

Ananya Vasagiri - Associate

Ananya Vasagiri -

Associate

Ananya has worked at the intersection of finance and industrial technology throughout her career. Her experiences include investment banking, digital industrial growth equity, and private market asset management. At Adams Street, she focused on investments into VC and PE funds across a broad range of strategies.

Ananya holds a BA in Economics and Psychology from The University of Chicago. Raised in California, she is a native Hindi speaker and a first generation American.